ui federal tax refund

Select Federal Tax and leave the Customer File Number field empty. Here youll see a drop-down menu asking the reason you need a transcript.

Interesting Update On The Unemployment Refund R Irs

The national hotline provides free 247 crisis counseling for people who are experiencing.

. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The 19 trillion coronavirus stimulus plan that. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Mental health - Call or text the Disaster Distress Helpline at 1-800-985-5990. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits.

Total the New York State tax withheld amounts from all IT-1099-UI forms. Click the Go button. Businesses in Related Categories to Tax Return Preparation.

But what this exclusion means is if you paid taxes on unemployment insurance. Undelivered Federal Tax Refund Checks. Refund checks are mailed to your last known address.

If your transcripttax software doesnt show an update amount to reflect an unemployment tax refund you can use this calculator to see if youll get one and how much. Federal Unemployment Tax Act FUTA taxes are paid entirely by employers who paid at least 1500 in wages during any. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

Postal Service USPS your. New York State Tax Refund. Include this total on the Total New York State tax withheld line on your New York State income tax return.

Federal Unemployment Insurance Account Numbers. Effects of the Unemployment Insurance Exclusion. Some taxpayers will receive refunds.

Connecticut State Tax Refund. Federal State Income Tax NJ 732 284-4955. If you move without notifying the IRS or the US.

These Taxpayers Will Get Refunds On Unemployment Benefits First The dates of residence would be 8142021 to 12312021. Massachusetts State Tax Refund. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

Chances are youve already paid your income taxes for 2020. State Unemployment Insurance Tax-- --State. The 10200 tax break is the amount of income exclusion for.

IRS efforts to correct unemployment compensation overpayments will help most affected taxpayers avoid filing an amended tax return. Virginia State Tax Refund. If youre getting one.

Federal Tax Refund 1040 Click.

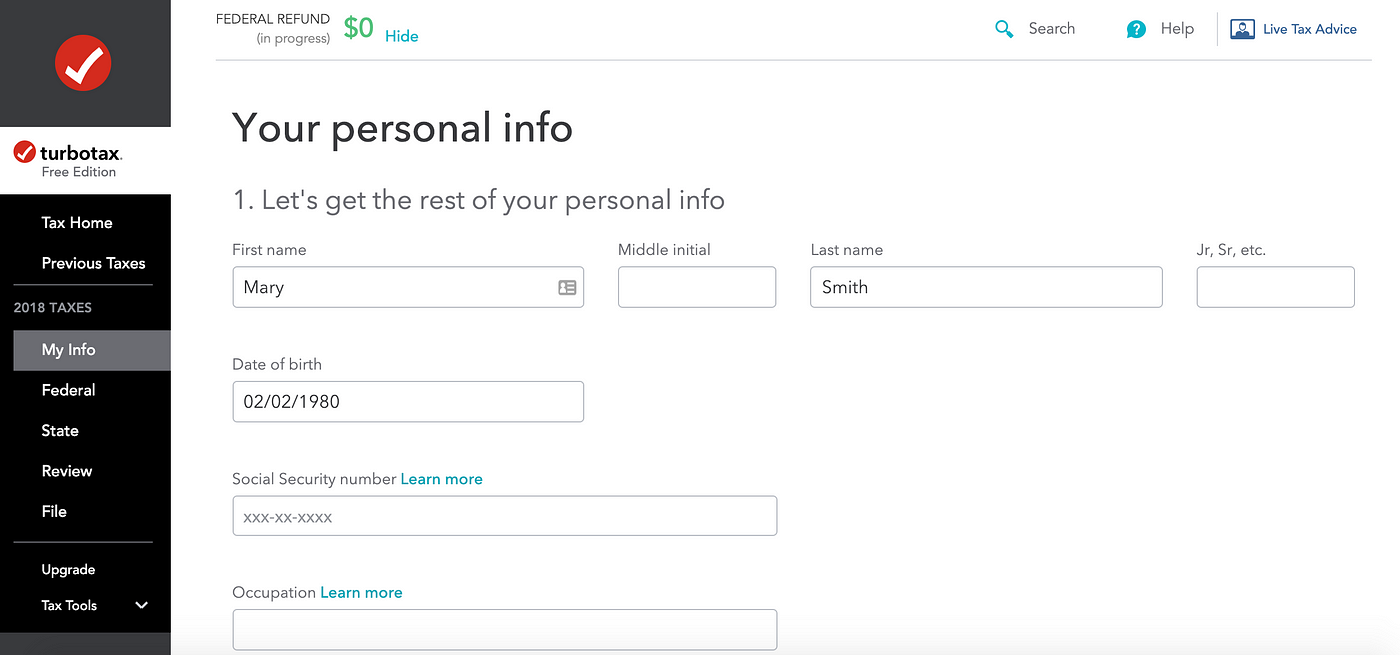

Why I Love Filing My Taxes A Ux Ui Analysis Of Turbotax By Emilia Totzeva Ux Collective

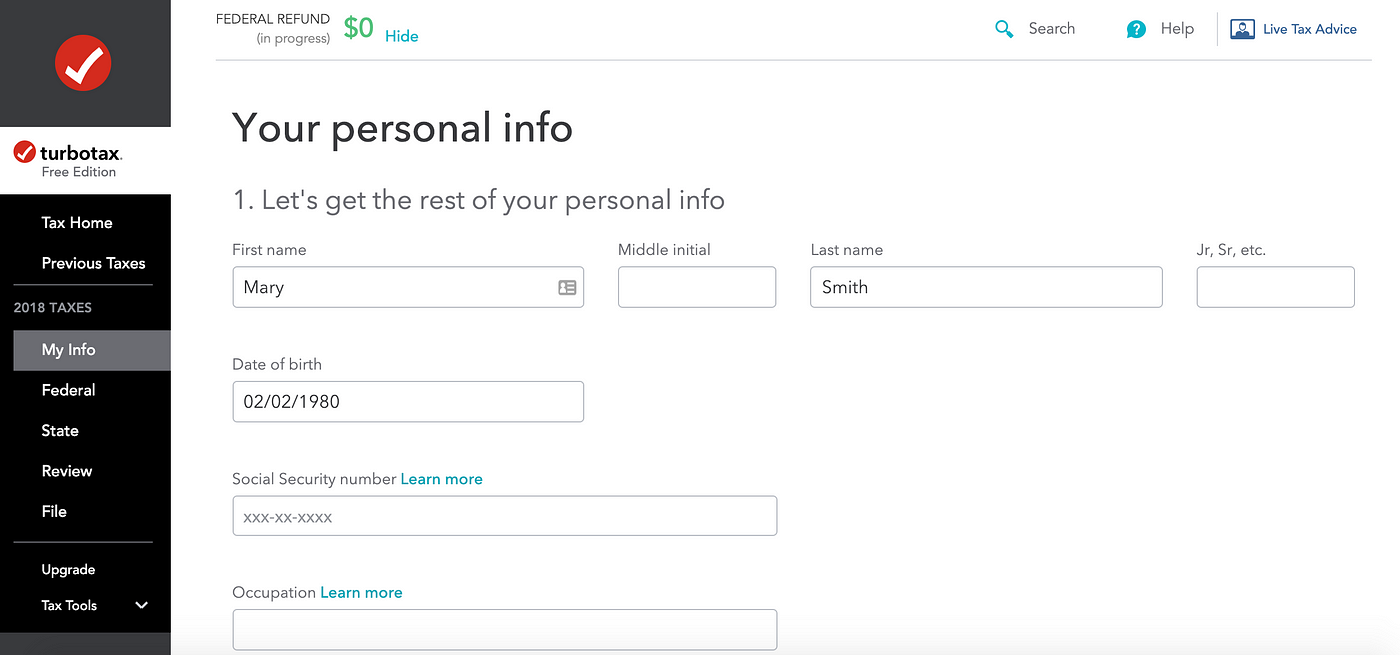

Solved According To The Irs Individuals Filing Federal Chegg Com

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Is Unemployment Taxed H R Block

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

It S Here Unemployment Federal Tax Refund R Irs

The Case For Forgiving Taxes On Pandemic Unemployment Aid

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

State Income Tax Returns And Unemployment Compensation

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

What Is The Federal Unemployment Tax Rate In 2020

When Will Proseries Update The New Unemployment Waiver Where 10 200 Of Unemployment Is No Longer Taxed By Federal Intuit Accountants Community

California Edd 1099g Tax Document In The Mail California Unemployment Help Career Purgatory